ITR 4 Return Filing

Form ITR-4 is submitted by taxpayers who have chosen the Presumptive Taxation Scheme under sections 44A, 44AD, or 44AE of the Income Tax Act, 1961. However, it’s important to note that this applies only if the business turnover is within the prescribed limit. In the event that the turnover exceeds Rs. 2 crore, the taxpayer is obligated to file Form ITR-3.

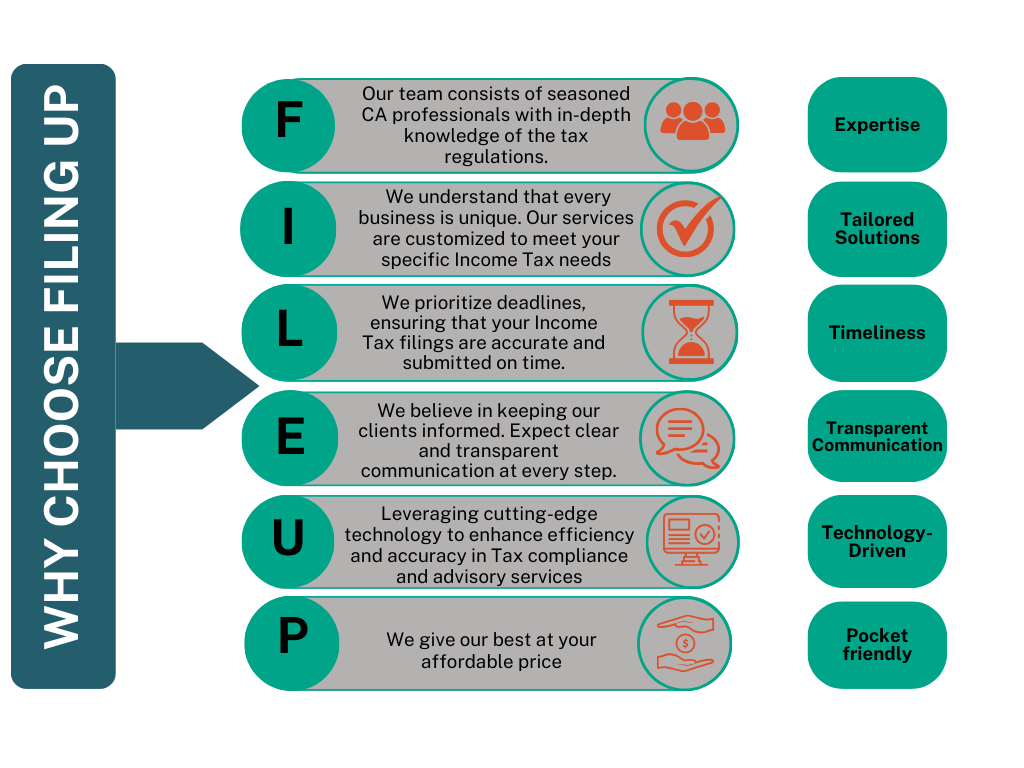

Our team at FilingUp plays a pivotal role in ensuring round-the-clock compliance for Indian Tax payers within the intricacies of the legal landscape. We ensure fast, error free government compliance.

FilingUp easy process

Why choose FilingUp

Pricing Summary:

Market Price

₹3499

Our Price

₹2499

Quick Contact !

Documents required:

- Bank Statement

- PAN Card

- Aadhar Card

FAQs

I am an individual having business income; can I opt for a new tax regime while filing ITR-4 ?

Yes you can opt for new tax regime. If you generate business income and intend to opt for the new tax regime, it is necessary to submit Form 10-IE before proceeding with the ITR filing.

I am an individual having business income. Can I switch between the old tax regime and new tax regime every year?

Individuals with business income do not have the annual flexibility to choose between the new and old tax regimes. Once they select the new tax regime, they are granted a one-time opportunity to revert to the old tax regime during their lifetime. After reverting, they are not allowed to choose the new tax regime again.

In essence, individuals earning business income might need to complete Form 10-IE on two occasions – first to adopt the new tax regime and secondly to transition back to the old regime.

What is the due date of filing form 10 IE for opting/withdrawing new tax regime?

According to income tax regulations, a person with business income must file Form 10-IE before the respective due dates for filing ITR, which are July 31 for non-audit cases and October 31 for cases where audit is applicable.