ITR 7 Return Filing

Filing of the ITR 7 Form is applicable to companies that derive income from properties earmarked for charitable or religious purposes. This includes properties held under trusts or legal obligations, either partially or entirely.

Taxpayers can complete the ITR 7 Forms through various methods, including submitting returns via a barcoded form, utilizing physical paperback forms, employing digital signature mode, or validating return submission through ITR Form V.

The ITR 7 Form is mandated when individuals and companies fall under the purview of Section 139(4A), Section 139(4B), Section 139(4C), or Section 139(4D).

Our team at FilingUp plays a pivotal role in ensuring round-the-clock compliance for Indian Tax payers within the intricacies of the legal landscape. We ensure fast, error free government compliance.

FilingUp easy process

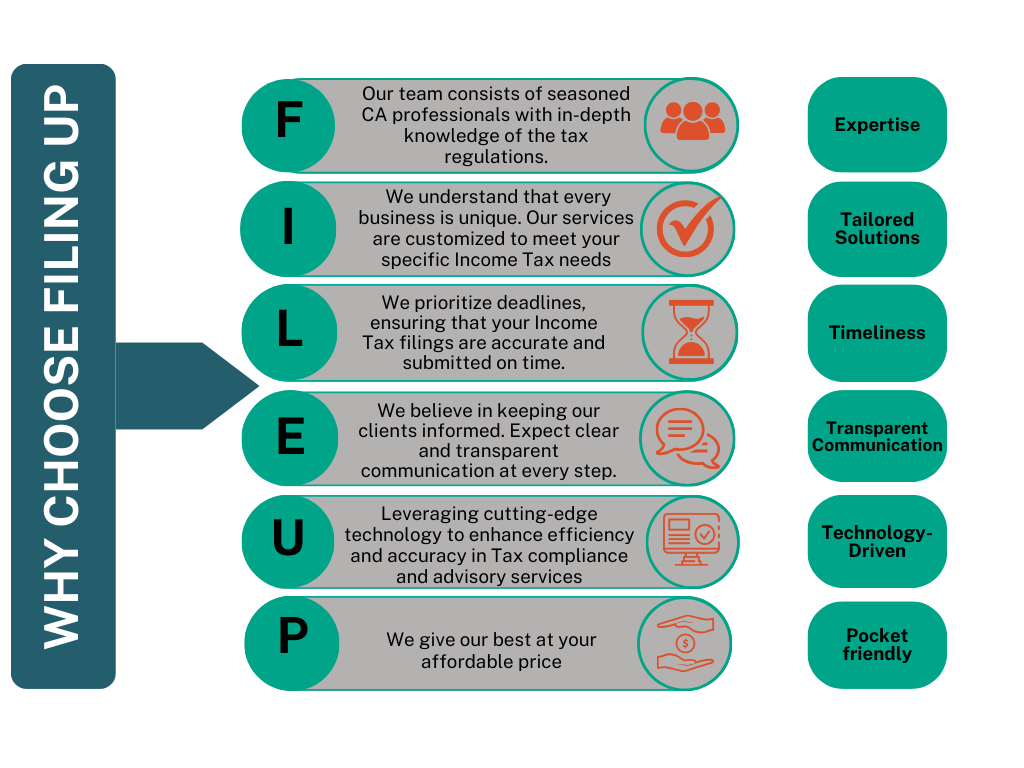

Why choose FilingUp

Pricing Summary:

Market Price

₹6499

Our Price

₹4999

Quick Contact !

Documents required

- Organisation PAN

- Details of Trustees or Trust members or Directors

- DSC or EVC of Managing Trustee or Chief functionary of the organisation

- Audited Financial statements of the Organisation

- Income Computation

FAQs

Does ITR 7 require the furnishing of information about a Tax audit?

Certainly, if an entity is obligated to undergo auditing under Section 44AB and has enlisted the services of a chartered accountant for the audit, it is imperative for the entity to provide pertinent details in ITR-7. This includes comprehensive information concerning the audit report and the specific date on which the report was submitted to the tax department.

Who cannot file through ITR 7?

ITR-7 cannot be filled by the following taxpayers: Individual, Companies, and HUFs Those entities who have filed the return through new ITR-5 and ITR-6