Other Services

1. Accounting & Bookkeeping

Accounting and bookkeeping are essential components of managing the financial aspects of a business. They involve the systematic recording, organizing, and reporting of financial transactions. Here’s an overview of both:

Definition

Accounting is a broader process that includes the analysis, interpretation, and presentation of financial data. It involves turning the raw financial data into useful information for decision-making whereas Bookkeeping is the process of recording daily financial transactions of a business, such as sales, purchases, receipts, and payments.

Objective

The main purpose of accounting is to provide stakeholders with relevant and reliable information about the financial position and performance of a business and the primary goal of bookkeeping is to maintain accurate and up-to-date records of financial transactions.

FILINGUP

FILINGUP provides you a meticulous and results-driven accountant specializing services in providing top-notch bookkeeping services to businesses and entrepreneurs. With a passion for numbers and a keen eye for detail, our experts thrive on helping clients maintain accurate financial records and make informed decisions to drive their business success to skies.

Some important Key aspects of Accounting:

Quick Contact !

2. INTERNAL AUDIT

Internal audit is an independent, objective assurance and consulting activity designed to add value and improve an organization’s operations. It helps an organization accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes.

FILINGUP is your expert in internal auditing with CAs & professionals team with years of experience. Our expertise includes conducting financial audits, reviewing financial statements, and utilizing advanced Excel formulas and functions to analyze data and create informative reports. We have a team with a keen eye for detail and a strong ability to spot trends and anomalies in data sets. Our goal is to provide accurate and reliable results, delivering high-quality work that exceeds clients’ expectations. Let’s work together to take your business to the next level with our auditing skills.

Some important Key aspects of Internal Audit:

Internal audit plays a crucial role in helping organizations achieve their goals by providing insights into their operations, identifying areas for improvement, and ensuring that risks are effectively managed. It is an essential component of good corporate governance.

Who needs Internal Audit

- Businesses and Corporations

- Nonprofit Organizations

- Government Agencies

- Educational Institutions

- Healthcare Organizations

- Financial Institutions

- Manufacturing Companies

- Technology Companies

- Construction and Engineering Companies

- Energy and Utilities

- Real Estate Organizations

Have any Questions? Call us Today!

+91 9000 405 305

+91 7498 712 123

3. STATUTORY AUDIT

A statutory audit is a mandatory examination of an entity’s financial statements and accounting records by an independent auditor to ensure compliance with statutory requirements and regulations. The primary purpose of a statutory audit is to provide assurance to stakeholders, such as shareholders, creditors, and the government, regarding the accuracy and fairness of the financial information presented by the audited entity.

FILINGUP is your expert in Statutory audit with experienced CAs & professionals team with years of experience. Our expertise includes conducting financial audits, reviewing financial statements, and utilizing advanced Excel formulas and functions to analyze data and create informative reports. We have a team with a keen eye for detail and a strong ability to spot trends and anomalies in data sets. Our goal is to provide accurate and reliable results, delivering high-quality work that exceeds clients’ expectations. Let’s work together to take your business to the next level with our auditing skills.

Some important Key aspects of Statutory Audit:

Statutory audits are commonly associated with companies and other legal entities, and the requirements can vary depending on the jurisdiction, industry, and size of the organization. The goal is to enhance the credibility and reliability of financial information, protect the interests of stakeholders, and ensure accountability and transparency in financial reporting.

It’s important to note that the specific requirements for statutory audits can vary significantly from one jurisdiction to another. We at FILINGUP are aware of the various regulatory environment in which your business operates and we understand whether statutory audits are mandated for your particular circumstances and we advise accordingly

Who needs Statutory Audit

- Public Companies

- Private Companies

- Nonprofit Organizations

- Government Entities

- Banks and Financial Institutions:

- Insurance Companies

- Pension Funds

- Listed Securities

- Large Corporations

- Regulatory Compliance

Have any Questions? Call us Today!

+91 9000 405 305

+91 7498 712 123

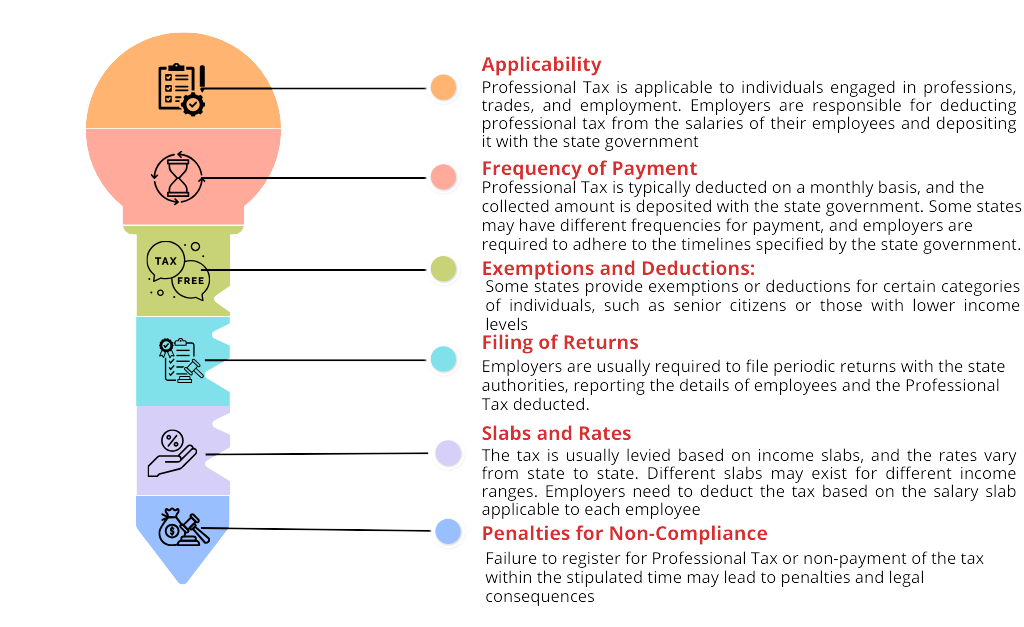

4. PROFESSIONAL TAX

Professional Tax is a state-level tax imposed by the government on income earned by individuals engaged in various professions, trades, and employment. This tax is levied by state governments in India and is governed by the respective state’s professional tax act. Each state in India has its own Professional Tax Act, and the rates and rules may vary from one state to another.

It’s important for businesses and individuals to be aware of the specific regulations governing Professional Tax in their respective states and ensure compliance with the applicable rules.

Wait…..You don’t have to worry of all these regulations because you have APKA APNA CA at FilingUP who will assist and cater you with all your Professional Tax needs and ensure the proper line of compliance as applicable to you.

Some important Key aspects of Professional Tax:

Have any Questions? Call us Today!

+91 9000 405 305

+91 7498 712 123

5. DIN

In the context of India, DIN stands for Director Identification Number. It is a unique identification number assigned to individuals who wish to become directors of companies registered under the Companies Act, 2013. Here’s who is required to obtain DIN in India

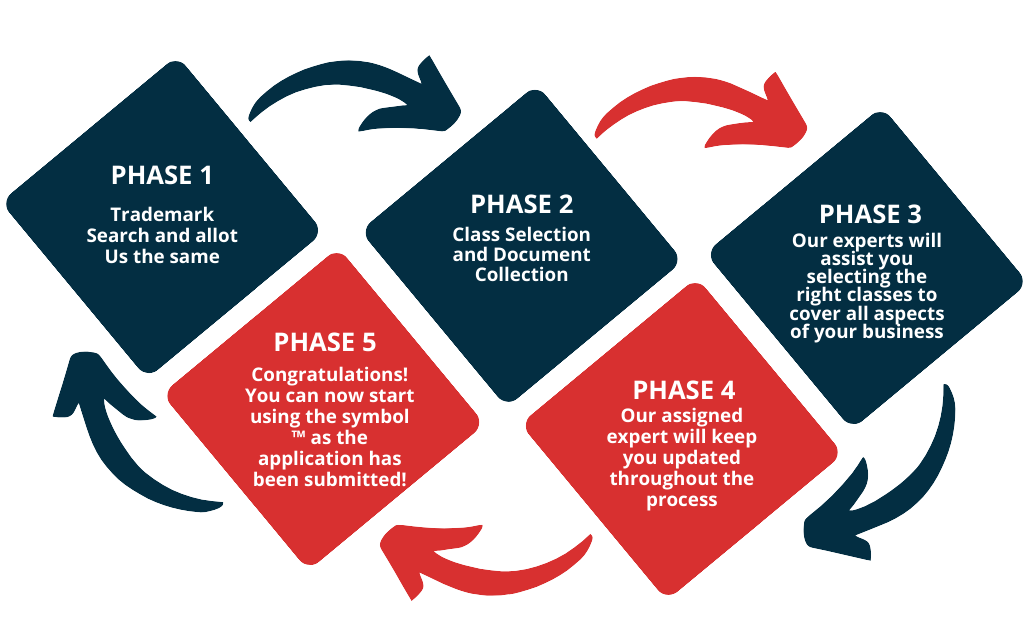

We at FilingUp make sure that you do not waste your precious time and resources behind all tedious and time consuming legal registration/compliance works with the respective government departments hence we have legal experts to make your business journey hassle free and smooth with just 5 step process.

PROCESS

Documents required

- Photograph

- Proof of identity

- Proof of residence

- Aadhaar, Passport, Voter ID, or Driver's License are commonly accepted

Who Needs DIN

- Existing Directors

- New Directors

- Designated Partners in LLP

- Changes in Particulars

- Foreign Nationals

- Company Secretaries and Cost Accountants

Individuals appointed as Company Secretaries and Cost Accountants in companies are also required to obtain DIN before their appointment.

It’s important to note that DIN is a unique identification number, and an individual is assigned only one DIN throughout their lifetime, regardless of the number of directorships they hold. The DIN system helps in maintaining a comprehensive and centralized database of directors, ensuring transparency and accountability in corporate governance.

Have any Questions? Call us Today!

+91 9000 405 305

+91 7498 712 123

6. Director KYC

Every DIN holder is required to file DIR-3 KYC form annually with the Ministry of Corporate Affairs (MCA) to update and verify their personal details before 30th September.

Late Filing

If DIR 3 KYC is not filed on before 30th September, late fees applicable is Rs. 5000 However, it’s important to verify the latest notifications or circulars from the MCA portal for any changes in the deadline and late fees.

We at FilingUp make sure that you do not waste your precious time and resources behind all tedious and time consuming legal registration/compliance works with the respective government departments hence we have legal experts to make your business journey hassle free and smooth with just 5 step process.

PROCESS

Documents required

- Photograph

- Proof of identity

- Proof of residence

- Aadhaar, Passport, Voter ID, or Driver's License are commonly accepted

FAQs

Who is required to file DIR-3 KYC form?

Every Director who was assigned a DIN on or before the end of the fiscal year and whose DIN status is ‘Approved’ would be required to file form DIR-3 KYC by the 30th of September of the following fiscal year.

Is a disqualified director required to file form DIR-3 KYC?

Yes. Anyone who has been assigned a DIN and whose DIN status is ‘approved’ is required to file form DIR-3 KYC. As a result, disqualified directors must also file form DIR-3 KYC.

Who are the signatories for DIR-3 KYC form?

The two signatories in form DIR-3 KYC are the DIN holder and a professional (CA/CS/CMA) certifying the form.

Please be aware that for Indian citizens, the PAN on the DSC is verified against the PAN on the form. In the case of foreign nationals, the name on the DSC should match the name on the form. DSCs attached to the form must be properly registered on the MCA portal.

Is multiple filing of DIR-3 KYC allowed?

The system will not allow an applicant to file form DIR-3 KYC more than once. If KYC has already been filed for a DIN and that DIN is entered again, the system reports that the form has already been filed.

Have any Questions? Call us Today!

+91 9000 405 305

+91 7498 712 123

7. Net worth certificate

A Net Worth Certificate is a financial document that provides information about an individual’s or entity’s net worth. Net worth is the difference between a person’s or company’s total assets and total liabilities. It is a measure of the individual’s or entity’s financial health and the extent to which their assets exceed their debts.

We at FilingUp make sure that you do not waste your precious time and resources behind all tedious and time consuming legal registration/compliance works with the respective government departments hence we have legal experts to make your business journey hassle free.

Components of Net Worth Certificate:

Assets: These are items of value that an individual or entity owns. Examples include cash, bank accounts, real estate, investments, vehicles, and other valuable possessions.

Liabilities: These are obligations or debts owed by the individual or entity. Examples include loans, mortgages, credit card debt, and other financial obligations.

The formula for calculating net worth is:

Net Worth = Total Assets – Total Liabilities

USE OF NET WORTH CERTICATE

The certificate is typically prepared by a certified accountant or a financial professional. It includes a detailed breakdown of assets and liabilities along with the calculated net worth. The document adds credibility to financial statements and provides a snapshot of an individual’s or entity’s financial position at a specific point in time.

Have any Questions? Call us Today!

+91 9000 405 305

+91 7498 712 123

8. Trademark registration

Trademark registration is a legal process that provides protection to distinctive signs, symbols, logos, names, and other identifiers used to distinguish goods or services of one business from those of others. Registering a trademark grants the owner exclusive rights to use the mark in connection with specific goods or services within a particular geographic region. The registration process helps prevent unauthorized use of similar marks by competitors and provides legal remedies for infringement.

Before applying for registration, conduct a comprehensive trademark search to ensure that the proposed mark is unique and does not conflict with existing trademarks. This search helps in identifying any similar or identical marks already registered.

Establishing a brand requires a considerable investment of time, dedication, and financial resources

Consequently, it’s imperative to ensure that you have the legal entitlements to utilize your brand’s logo, tagline, product shape and packaging, sound, fragrance, color combinations, and any other elements that contribute to its unique identity. A trademark is a category of intellectual property that sets apart your products or services from those of other competitors in the market.

In India, the Trademarks Act of 1999 authorizes you to register a trademark, providing exclusive ownership rights and prohibiting others from using the mark, thereby supporting the registered mark’s owner..

Once a trademark is officially registered the “TM” symbol can be affixed to both the applicant’s and the brand’s names. Essential for brand name protection in India, trademark registration is best pursued with professional assistance, given the intricate steps and the continuous government follow-up required.

The process of registering a trademark online is more intricate than it may seem initially, comprising multiple steps and requiring ongoing government follow-up.

FilingUp has simplified this for you by breaking it down into three distinct parts and assuming the bulk of the responsibilities. Take the step to register your trademark today to safeguard your company’s logo, slogan, and brand.

Simplified process with FilingUp

FAQs

Which Trademarks cannot be registered?

Any mark that closely resembles an already registered trademark or a trademark for which an application is pending is ineligible for registration. This is to prevent potential confusion among consumers and protect the rights of existing trademark holders

What is Trademark Class?

To ensure uniformity in the categorization of goods and services associated with a trademark, the trademark registry employs a classification system consisting of 45 Classes. Each class represents a distinct category of goods or services. When filing a trademark application, it is imperative to specify the particular class or classes under which the goods or services associated with the trademark fall. Trademark registration is then conferred specifically for the identified class or classes of goods or services

Is my trademark application valid globly?

While the validity of a trademark registered in India is confined to the Indian territory, it’s noteworthy that certain countries leverage the trademark filing in India as a foundation for pursuing registration in their respective jurisdictions.

How long it takes to obtain Trademark registration?

While the filing of a trademark application with the trademark registry can be swiftly accomplished within 1 to 3 days, the overall registration process entails the completion of formalities by the registry, and this typically extends the timeline to a duration ranging from 6 to 24 months before the trademark is officially registered.

When is the ‘R’ mark used?

Upon approval by the Controller General of Patents Designs and Trademarks and subsequent trademark registration, the ® symbol becomes available for use with the registered trademark.

What happens when the trademark application gets refused?

In the event that the trademark examiner issues a hearing notice to the applicant, failure to respond within 30 days from the date of receipt results in an automatic refusal of the application. In such instances, the remedy involves filing a new application to pursue trademark registration.

What is the validity of Trademark registration?

Registered trademarks maintain their validity for a period of 10 years, commencing from the date of filing. To ensure the continuous protection of the trademark, the owner has the option to apply for renewal before the expiration of this term.

Have any Questions? Call us Today!

+91 9000 405 305

+91 7498 712 123

9. FSSAI Registration

FSSAI stands for the Food Safety and Standards Authority of India. It is an autonomous body established under the Ministry of Health & Family Welfare, Government of India. FSSAI is responsible for formulating and enforcing food safety and standards in India to ensure the availability of safe and wholesome food for human consumption.

Our experts at FilingUp will ensure seamless process and help you select and get the right FSSAI registration depending upon your business characteristics

The documents & information required for basic FSSAI registration

- The photo Identity proof of the food business operators

- Proof of Address of premise (Rental Agreement)

- Partnership Deed / Certificate of Incorporation / Articles of Association if any

- Food products list

- Documents mentioning all the Directors/Partners/Executive Members etc

- Food safety management system plan

- Contact Information

- Information regarding Authorised Person including Photo ID Proof, Address Proof, Email ID, and Mobile Declaration Form in prescribed Format

- Form IX and Board Resolution in prescribed Format

- A List of Directors/Partners/Executive Members

- A Signed Copy of Form B

The documents & information required for FSSAI State License

- Food safety management system plan or certificate whichever is available

- No Objection Certificate and copy of License from the manufacturer (In case of Labellers and Packers)

- Analysis report of water to be used in the process to confirm the portability

- Name and list of various equipment and machinery used with the number and installed capacity (for Manufacturer)

- Production Unit Photograph (for Manufacturer)

- Certificate provided by Ministry of Tourism (forhotels)

- Document showing Turnover

The documents & information required for FSSAICentral License

- Undertaking from FBO in a prescribed Format

- IE Code Document issued by DGFT

- Ministry of Commerce Certificate (For 100% EOU)

- Food safety management system plan or certificate

- NOC and copy of License from the manufacturer (In case of Labelers and Packers)

- Analysis report of water to be used in the process to confirm the portability

- Name and list of various equipment and machinery used with the number and installed capacity (for Manufacturer)

- Production Unit Photograph (for Manufacturer)

- Certificate provided by Ministry of Tourism (for hotels)

- Declaration of Turnover

Have any Questions? Call us Today!

+91 9000 405 305

+91 7498 712 123

10. 15CA and 15CB

15CA and 15CB refer to forms that are part of the Indian Income Tax Act, and they are related to the taxation of certain types of transactions involving foreign remittances. These forms are required to be submitted to the Income Tax Department of India for specific transactions, particularly those that involve the remittance of money outside of India.

We at FilingUp make sure that you do not waste your precious time and resources behind all tedious and time consuming legal registration/compliance works with the respective government departments hence we have legal experts to make your business journey hassle free.

Form 15CA

Form 15CA is a declaration of remittance, and it is required for any payment or remittance to a non-resident. This form is used to collect information about the remittance and to ensure that appropriate taxes are deducted at the time of making the payment.

The person making the remittance (remitter) needs to fill out Form 15CA online on the official Income Tax Department website. This form captures details such as the purpose of remittance, amount, and the relevant section of the Income Tax Act under which the remittance is made.

Form 15CA is categorized into different parts, and the applicable part depends on the nature and purpose of the remittance. The form is submitted electronically, and a signed printout of the form (along with other documents, if required) is submitted to the authorized dealer (typically a bank) before the remittance is processed.

Form 15CB

Form 15CB is a certificate of an accountant, and it is required to be obtained by the remitter. A chartered accountant must certify the details of the payment, the TDS (Tax Deducted at Source) deduction, and the compliance with the provisions of the Income Tax Act.

Before filing Form 15CA, the remitter must obtain a certificate in Form 15CB from a chartered accountant. The accountant certifies that the provisions of the Income Tax Act have been duly complied with, and the remittance is in accordance with the relevant rules and regulations.

In summary, Form 15CA is a declaration made by the remitter, and Form 15CB is a certificate issued by a chartered accountant. Both forms are required for certain foreign remittances to ensure compliance with Indian tax laws and to prevent tax evasion. The process is designed to monitor and regulate cross-border financial transactions. It’s important for individuals and businesses involved in such transactions to comply with these requirements to avoid legal and tax-related issues.

The Import Export Code (IEC) is a 10-digit unique code issued by the Directorate General of Foreign Trade (DGFT), which operates under the Ministry of Commerce and Industry in India. The IEC is a mandatory requirement for individuals or businesses engaged in the import and export of goods and services from or to India. It is a key document that facilitates international trade and is used for clearing customs and obtaining various benefits from the government.

Here are some key points about the Import Export Code:

Mandatory Requirement:

Obtaining an Import Export Code is mandatory for any person or entity involved in import or export activities in India. This includes individuals, companies, partnerships, LLPs, and others.

Unique Identification:

The IEC serves as a unique identification number for the entity engaged in international trade. It is used in all communications with government authorities and other stakeholders.

No Restrictions on Import/Export:

With an IEC, there are no restrictions on the type of goods or services that can be imported or exported, unless specifically restricted by other government agencies.

Application Process:

The application for an Import Export Code is submitted to the DGFT through an online portal. The application requires details such as the entity’s PAN (Permanent Account Number), bank account details, and other relevant information.

Individual and Business Entities:

Both individuals and business entities can apply for an IEC. The process and documentation may vary based on the type of entity (e.g., sole proprietorship, company, partnership).

Validity:

The Import Export Code does not have an expiry date, and once obtained, it can be used for all import and export transactions unless surrendered or cancelled.

Benefits:

The IEC is required for customs clearance, and it facilitates availing benefits under various government schemes. It is also necessary for opening a foreign currency bank account and obtaining various licenses and registrations related to international trade.

Amendment and Surrender:

If there are any changes in the information provided in the IEC application, amendments must be made promptly. Additionally, if the entity ceases to engage in import/export activities, the IEC can be surrendered.

Online Verification:

The IEC can be verified online through the DGFT website, providing transparency and ease of verification for trading partners.

Obtaining an Import Export Code is a fundamental step for businesses involved in international trade in India. It simplifies the process of importing and exporting goods, ensures compliance with regulations, and enables entities to avail themselves of various benefits provided by the government for promoting international trade.

Have any Questions? Call us Today!

+91 9000 405 305

+91 7498 712 123

11. RERA

RERA stands for the Real Estate (Regulation and Development) Act. It is a significant piece of legislation in India that was enacted to regulate and promote the real estate sector in the country. The primary objective of RERA is to protect the interests of homebuyers and promote transparency and accountability in the real estate industry. The act came into effect on May 1, 2017.

We at FilingUp make sure that you do not waste your precious time and resources behind all tedious and time consuming legal registration/compliance works with the respective government departments hence we have legal experts to make your business journey hassle free.

Features of RERA include:

Regulation of Real Estate Projects:

RERA mandates that real estate developers register their projects with the regulatory authority before advertising or selling. This registration includes providing details about the project, including approvals, timelines, and financial aspects.

Transparency and Accountability:

Developers are required to disclose information such as project details, layout plan, land status, approvals, and schedule for completion to the regulatory authority and potential buyers. This ensures transparency in real estate transactions.

Project Delays and Compensation:

RERA aims to address project delays by holding developers accountable for completing projects on time. If there is a delay, developers are liable to compensate homebuyers for any losses incurred due to the delay.

Advance Payments:

RERA restricts developers from demanding more than 10% of the property’s cost as an advance or booking amount before signing a sale agreement.

Quality of Construction:

The act emphasizes the quality of construction, and developers are obligated to adhere to the prescribed quality standards. Any structural defects or poor workmanship must be addressed by the developer.

Formation of Resident Welfare Associations (RWAs):

RERA mandates the formation of Resident Welfare Associations in a timely manner. The responsibility for the common areas and facilities is transferred to these associations once a certain percentage of units are sold.

Real Estate Regulatory Authority (RERA):

Each state and Union Territory in India has a Real Estate Regulatory Authority that oversees the implementation of RERA provisions. The authority acts as a regulatory body to address grievances and ensure compliance with the act.

RERA has significantly impacted the real estate sector in India by bringing in greater transparency, accountability, and fairness in property transactions. It provides a legal framework to address the concerns of both developers and homebuyers, contributing to the overall growth and stability of the real estate market. It’s important to note that specific provisions of RERA may vary from state to state, as real estate is a subject that falls under the concurrent list of the Constitution of India, allowing both the central and state governments to legislate on it.

Have any Questions? Call us Today!

+91 9000 405 305

+91 7498 712 123

Subscribe to Newsletter

Subscribe to Newsletter to get updated Government notifications