Form 16

Form 16 is an important paper for people who work for a salary in India. It’s like a proof given by employers to their employees, confirming that they have taken out the right amount of taxes from their salary and given it to the government. This paper shows all the details of the money employees received, including the taxes taken out. Form 16 has all the information needed for individuals to put together and submit their income tax return

Employers are obligated to issue the Salary TDS certificate annually, no later than the 15th of June of the subsequent year following the financial year in which the tax was deducted. Form 16 comprises two sections: Part A and Part B. In the event of Form 16 being lost, individuals have the option to request a duplicate form from their employer

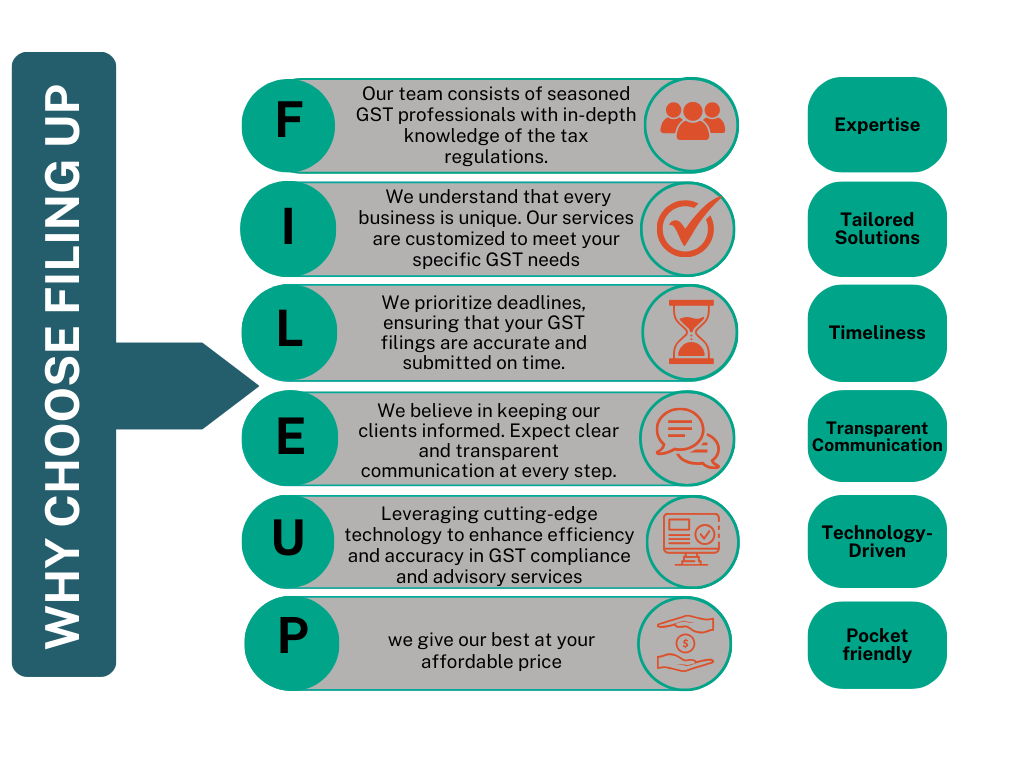

Why Choose Us

We offer online TDS compliance management services to assist you effectively. Our team of TDS experts is dedicated to handling the filing of all TDS returns, settling any outstanding TDS deposits, and facilitating the issuance of Form 16 to your employees

Pricing Summary:

Market Price

₹1499

Our Price

₹1499

Quick Contact !

Details Required for Form 16 while filing your income Tax return

- Allowances exempt under Section 10

- Break up of deductions under Section 16

- Taxable salary

- Income (or admissible loss) from house property reported by an employee and offered for TDS

- Income under the head ‘Other Sources’ offered for TDS

- Break up of Section 80C deductions

- The aggregate of Section 80C deductions (gross and deductible amount)

- Tax payable or refund due

Form 16 is a crucial document for salaried individuals in India, and it offers several advantages:

- Proof of Income: Form 16 serves as a comprehensive proof of the income earned by an individual during a specific financial year. It provides details about the salary, allowances, and deductions.

- Tax Deducted at Source (TDS) Details: Form 16 provides a summary of the TDS deducted by the employer on behalf of the employee. It includes information on both salary and non-salary TDS.

- Ease of Tax Filing: Form 16 simplifies the process of filing income tax returns. The details provided in the form are essential for accurately calculating and reporting income while filing taxes.

- Compliance Confirmation: By issuing Form 16, the employer acknowledges that they have deducted the appropriate amount of TDS and deposited it with the Income Tax Department, ensuring compliance with tax regulations.

- Information for Tax Planning: Form 16 contains detailed information about salary components, exemptions, and deductions. This information is valuable for individuals in planning their taxes and optimizing their tax liabilities.

- Loan Application Requirement: Form 16 is often required as part of documentation when applying for loans, such as home loans. Lenders may request it to verify the income details of the applicant.

- Employment Verification: Form 16 can be used as a document to verify employment and income details. This is especially useful when individuals need to provide proof of income to other parties or agencies.

- Consolidated View of Income: For individuals with multiple sources of income, Form 16 provides a consolidated view of the income earned from employment, making it easier to manage and report total income.

- Facilitates Tax Planning: The detailed breakup of salary components and deductions in Form 16 helps employees understand their tax liability better, enabling them to plan their finances more effectively.

- Reduces Tax Compliance Burden: Form 16 streamlines the process of tax compliance for salaried individuals by providing a standardized and comprehensive document that includes all the necessary details required for tax filing.

It’s important to note that while Form 16 is advantageous, individuals should also be aware of other supporting documents and tax regulations to ensure accurate and compliant tax filing.

FAQs

What is the importance of Form 16?

Employers issue Form 16 to salaried individuals upon deducting taxes from their salaries. This document serves as an acknowledgment, confirming that the deducted tax has been successfully deposited with the Income Tax Department.

How to get Form 16?

Obtain your Form 16 directly from your employer. Your employer will furnish you with Form 16, even after you’ve left the job. Unfortunately, you cannot access this Income Tax Form 16 through any online platform.

I don’t have Form 16. How do I file my return?

Even though it’s a crucial document, there’s no cause for worry if you lack it. We can still file your return, to learn more reach out to us @9000 405 305.

If there is no TDS deducted, is the employer required to issue a Form 16?

When TDS has been deducted, you will receive the TDS certificate in Form 16.If the employer has deducted no TDS, he may not give you Form 16.

When does the employer deduct TDS and does not issue a certificate?

Any person responsible for paying a salary must deduct TDS before making payment. According to the provisions of the Income Tax Act, anyone deducting TDS from a payment is required to provide a certificate containing details of the deducted and deposited TDS. An employer must mandatorily provide a certificate in the Form 16 format

If no Form 16 has been issued to me, does it mean I don’t have to pay tax or file a return?

Although the responsibility of deducting tax from salaries and issuing Form 16 lies with the employer, the responsibility of paying income tax and filing a tax return rests with you. Even when he fails to issue you a Form 16, you must file an income tax return and pay off the due taxes.