Handling Income Tax Notice

The Income Tax Department sends notices for different reasons. This could include situations where someone hasn’t filed their income tax returns, there are mistakes in the filed returns, or when the tax department needs more documents or information from the taxpayer.

There is nothing inherently worrisome or distressing about the received notice. However, it is essential for the taxpayer to comprehend the notice, understand its nature, grasp the instructions from the requester, and take the necessary actions to comply.

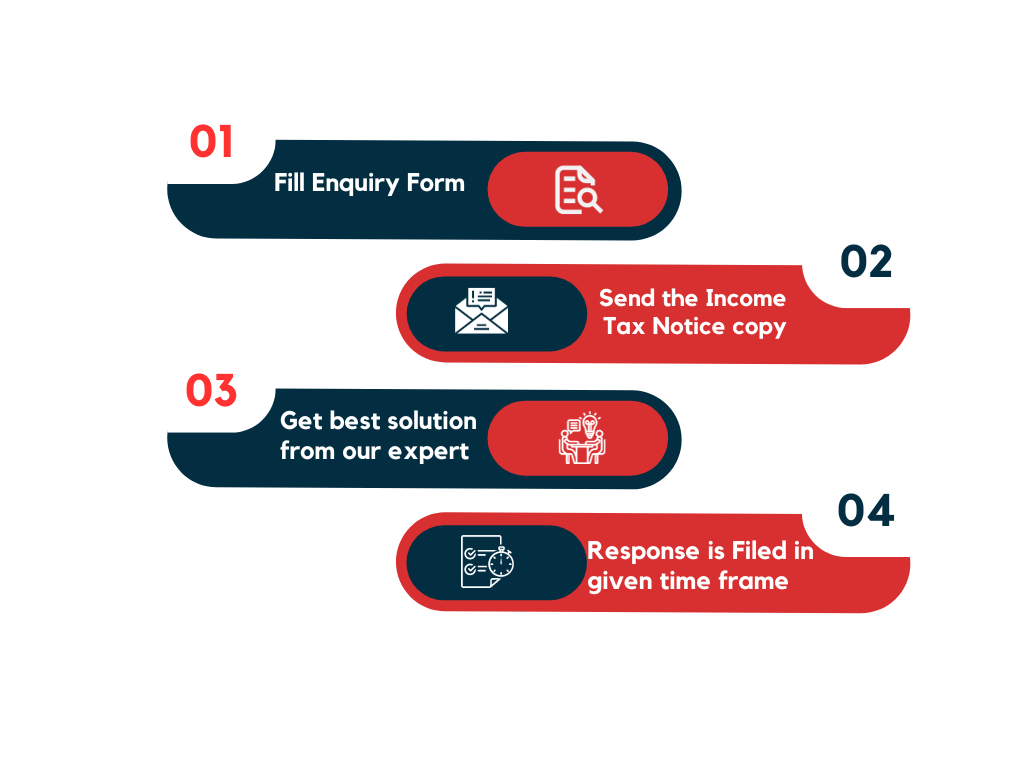

FILINGUP provides an extensive range of services catering to the needs of both families and businesses, assisting them in adhering to regulatory requirements. Should you receive an income tax notice, our team of Tax Experts is readily available to offer guidance.

Reach out to us at FilingUp to gain a thorough understanding of the income tax notice and devise an appropriate course of action and get Filing Up assistance from a Tax Expert in handling and responding to income tax notices with affordable prices

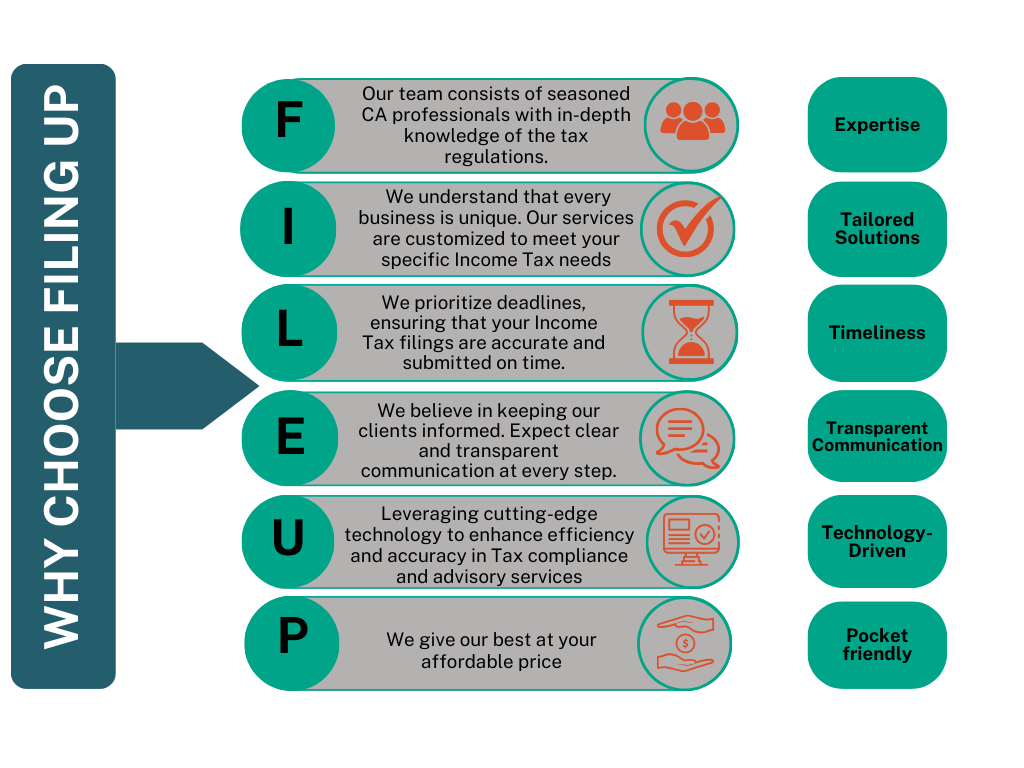

Why choose FilingUp

Pricing Summary:

Market Price

₹14999

Our Price

₹4999-10000

Quick Contact !

Necessary Documents

The documents necessary may differ based on the specific type of Income Tax notice issued to the taxpayer. However, the fundamental documents required to respond to an income tax notice typically include:-

- The Income Tax Notice copy.

- Proof of Income source such as (Part B ) of Form 16, Salary receipts, etc.

- TDS certificates, Form 16 (Part A)

- Investment Proof if they are applicable.

FAQs

What is meant by defective return under 139 (9)?

Assessing Officer issues Notice 139 (9) when discrepancies or inaccuracies are found in the taxpayer’s filed Income Tax Return (ITR). The notice not only outlines the identified errors but also provides a detailed description of the issues along with recommended solutions for rectification.

What is Section 131 (1A) and what is the reason to get this notice?

If the Assessing Officer suspects income concealment by the taxpayer, a notice under Section 131(1A) is issued. This notice serves as intimation that the AO is commencing an inquiry or investigation into the matter.

What is Section 245?

Section 245 functions as a notification, wherein this notification signifies the adjustment of the taxpayer’s refund, either entirely or partially, against outstanding previous tax liabilities.

What is time period given by the Income Tax Department to file a response to such notices/intimations?

The response to the Income Tax notice must be furnished within 15 days from the date of the intimation issued by the assessing officer. If an extension is required, a written request can be submitted to the local assessing officer.