GST LUT Filing

LUT in GST stands for Letter of Undertaking, and it is formally submitted using Form GST RFD 11 under rule 96 A. Through this declaration, an exporter commits to fulfilling all prescribed GST requirements for exports without making an IGST payment.

Documents required

- Identity proof of the witnesses

- Address proof of the witnesses

- Consent letter of witnesses agreeing on terms for such LUT

- Acceptance letter from department acknowledging Letter of Undertaking of any previous year.

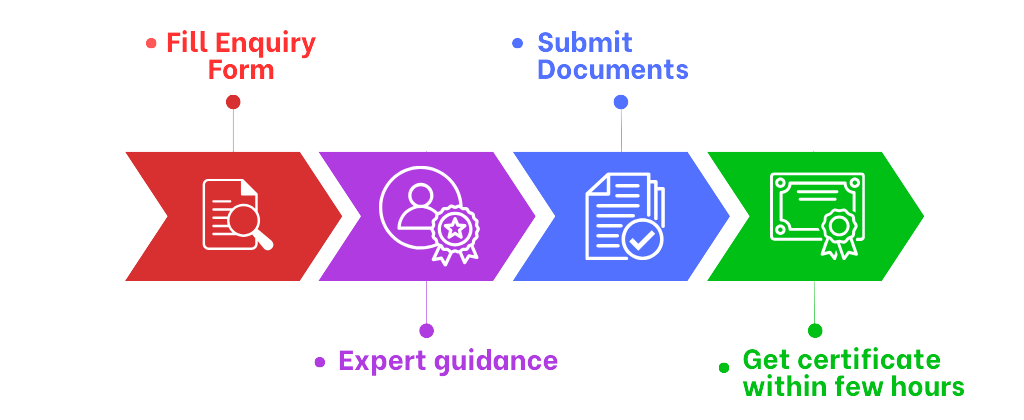

FilingUp easy process

Why choose FilingUp

FILINGUP stands out as a premier business service hub in India, providing comprehensive GST solutions from registration to seamless return filing. Our expertise has facilitated numerous entrepreneurs in obtaining GST registration and navigating the intricacies of filing returns

Pricing Summary:

Market Price

₹1900

Our Price

₹1499

Quick Contact !

FAQs

Whether LUT is required if a person intends to supply to SEZs?

Yes, in the case of a supplier supplying goods or services to a Special Economic Zone (SEZ), it is necessary to provide a Letter of Undertaking. This undertaking is to be submitted in the prescribed form GST-RFD 11 under rule 96A.

Can LUT be accessible after applying on the portal?

A person will be able to see his ARN by navigating to Services Tab > User Services > View My Submitted LUTs.

Is a bank guarantee required for Filing LUT?

There is no need for a bank guarantee when submitting a Letter of Undertaking (LUT) for the export of goods or services under GST. Nevertheless, if choosing to submit a Bond in lieu of an LUT, additional documents such as a Bond on Stamp Paper, Bank Guarantee, Letter of Authority (for non-individual taxpayers), and other supporting documents are mandatory.